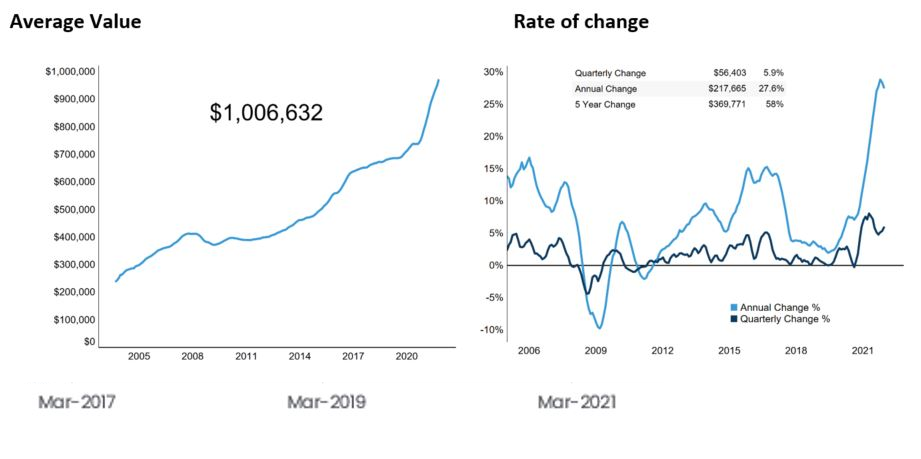

CoreLogic's House Price Index (HPI), which is the most complete and robust measure of property value change in the market, today showed some heat remains in the property market, though the signs of an upcoming cool-down linger. Nationally, property values rose 1.9% over December, a slight lift on November's rate of growth (1.8%).

The December reading closes out a record year for the Aotearoa property market, with 27.6% growth over the full calendar year exceeding the previous record of 24.4% growth witnessed in 2003. The average value of a New Zealand home now exceeds $1m for the first time, sitting at $1,006,632.

CoreLogic NZ Head of Research Nick Goodall said "2021 has truly been a remarkable year in the property market, with low interest rates and the continued ability for most borrowers to secure finance both key contributors to persistently strong demand for residential property. It must be acknowledged though that both these factors are changing.

"Since the changes to the Credit Contract and Consumer Finance Act (CCCFA) on 1 December 2021, which brings greater scrutiny of a potential borrower's expenses and ability to repay their loan, feedback from mortgage advisors has been very strong that the tightening has gone too far.

"While the changes clearly haven't impacted all borrowers immediately, with values still rising at above average rates, they are likely to be felt more widely throughout 2022 as rising interest rates and diminishing affordability combine to reduce borrowing capacity,” said Mr Goodall.

CoreLogic House Price Index - National

Mr Goodall said despite persistently strong monthly value increases, the annual rate of growth dropped for the second month in a row after peaking at 28.8% at the end of October 2021, illustrating nothing can grow forever.

The big question now is whether the conditions turn so much that values actually start to drop. High inflation is leading to forecasts of continued upward movement in the Official Cash Rate (OCR). The Westpac economics team, for example, forecast the OCR to hit 2.00% by September 2022. But with responsible lending practices ensuring both equity (through loan-to-value ratio restrictions) and servicing of mortgages (through assessment interest rates) can handle market change, alongside a strong labour market, the likelihood of forced sales or even motivated vendors remains low.

From a supply perspective, listings have swung to the positive which will improve choice for buyers and subsequently reduce some vendor power over pricing, but unless the vendor is an investor looking to divest their portfolio due to reduced profitability, their willingness to accept less than its perceived value will also be low – at least for the early part of 2022.

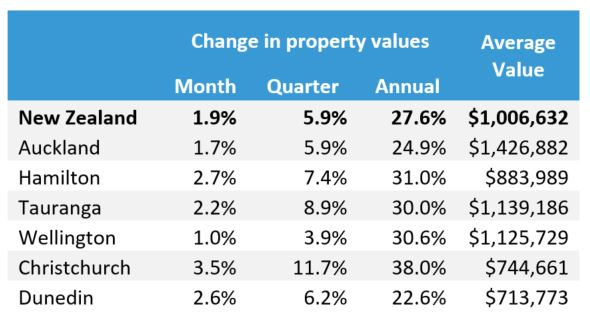

CoreLogic House Price Index - National and Main Centres

Looking into the index results for the main centres, momentum has been sustained in the final month of the year, however there have been some dramatic shifts in the annual rates of growth in both Tauranga and Wellington.

In Tauranga the annual rate of growth slowed from 35.8% at the end of November to 30.0% at the end of December, while in Wellington it dropped from 33.5% to 30.6% over the same period.

Christchurch continues to experience very strong monthly growth, at 3.5% over December, which takes the annual rate of growth to 38.0% extending the record breaking figure achieved last month.

Meanwhile the annual rate of growth in Auckland slightly dipped to 24.9% (from 25.7% in November).

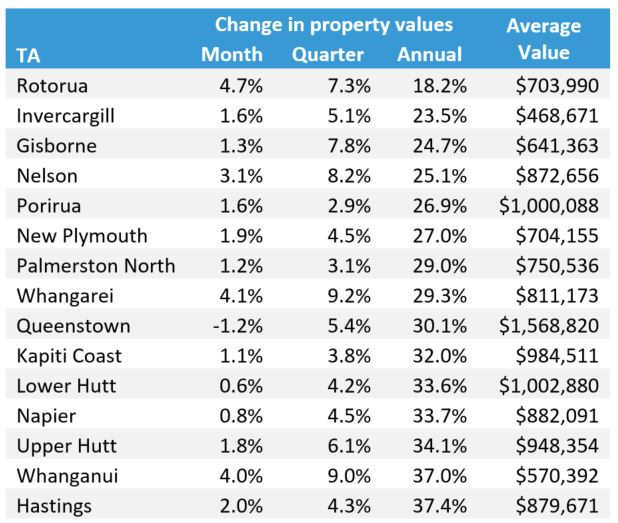

Provincial Centres ordered by annual growth (Source: CoreLogic)

The overarching trend across the provincial centres is that of a reducing rate of annual growth, though similar to the nationwide results momentum has remained in many of them.

The recent acceleration in property value growth in Queenstown has hit a speed bump, with values seeing a -1.2% drop in December, taking values back below the $1.6m mark they exceeded at the end of November. Previous optimism from the proposed border opening may have been scuppered by the arrival of the Omicron variant of Covid-19.

Further growth in both Lower Hutt (0.6% in December) and Porirua (1.6%) has seen the average property value in both cities tick over $1m. Nearby Kapiti Coast is also approaching this figure (currently $985k) after 1.1% growth in December.

Recent growth hasn't been quite as strong as other provincial centres in both the Rotorua (18.2% p/a) and Nelson (25.1%) markets in 2021, however they have both finished the year with solid momentum, seeing a lift across all three growth periods.

Similarly Whangārei and Whanganui finished the year strongly, with 9.2% and 9.0% growth respectively over the final three months of 2021.

DOWNLOAD THE DECEMBER HPI

Enquire about the CoreLogic House Price Index, request a copy of the latest data or subscribe to future updates here.