Property values across Aotearoa New Zealand flat-lined in September, most likely ending the 17-month downturn, the CoreLogic House Price Index (HPI) shows.

Nationally, average values stabilised at $905,445 in September, with the three-month change sitting at -0.6%. From March 2022’s peak, the total fall has been 13.2%, although average values remain 24.3% higher than ‘pre-COVID’ in March 2020.

Around the main centres the wider Wellington area was flat in September, with Christchurch and Dunedin edging up by 0.2% apiece. CoreLogic NZ Chief Property Economist, Kelvin Davidson said the most notable main centre was Auckland, where values rose by 0.4%, the city’s first increase since March 2022.

“It was only a matter of time until property values found their floor and then started to rise again, and it’s this emerging growth we’re starting to see in the data, although there’s quite a bit of diversity across the country,” Mr Davidson said.

“Housing market confidence seems to have turned a corner, supported by a rough peak for mortgage rates, high net migration flows, a still-solid labour market, and an easing in credit conditions. A growing expectation that National may lead the next Government, with more ‘property friendly’ policies, may well be playing a role here too.

“While a National-led Government may result in house prices rising more than otherwise might have been the case, the impact might be relatively muted. For example, the potential phased reinstatement of mortgage interest deductibility would tend to add some demand to the market. But a smaller tax bill wouldn’t change the fact that rental yields are still low and mortgage rates high, requiring a new property investor to put a significant cash top-up into the property to keep it going. Accordingly, a flood of new investors doesn’t seem particularly likely to me,” he said.

The signs of a turning point for Auckland, Christchurch, Dunedin and Wellington in September were not replicated in Tauranga and Hamilton, where values continued to fall by 1.2% and 1.5% respectively.

“This patchiness among the main centres may well continue in the coming months, and is likely to be a feature elsewhere in NZ too. After all, while we have broadly reached a trough in the market, we’re not expecting the next phase of growth to be swift or sudden either given mortgage rates remain challenging for many households.”

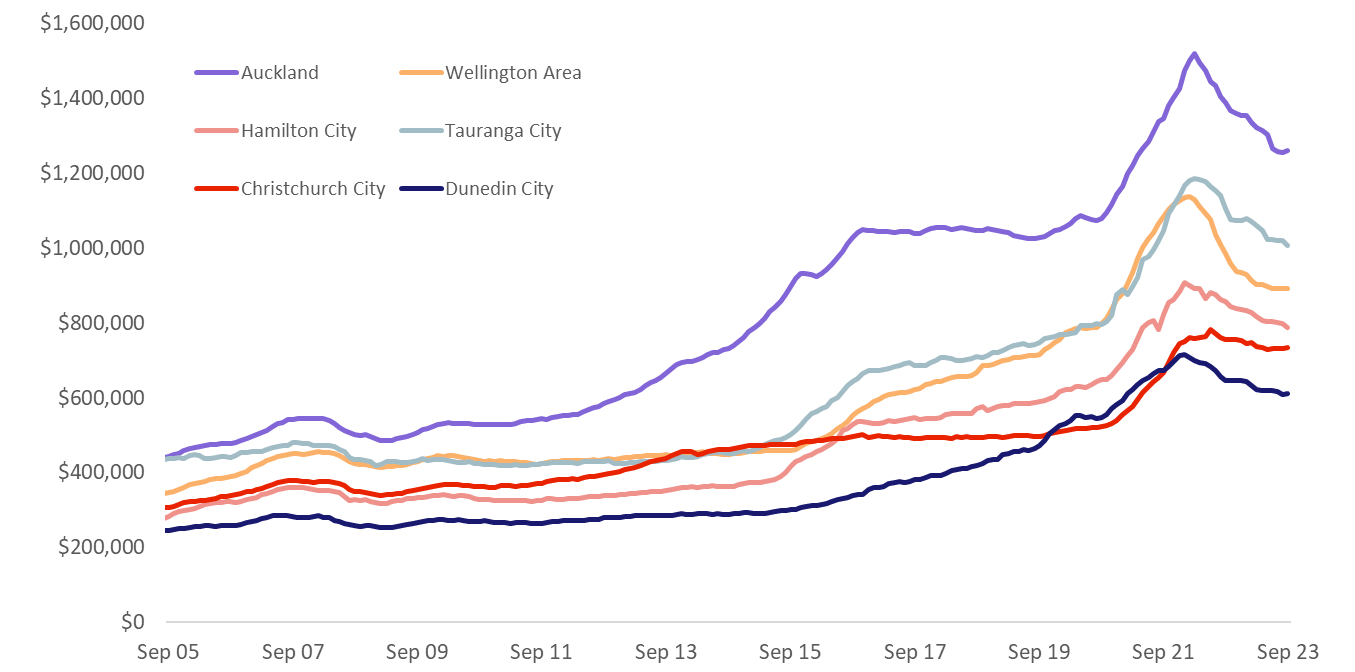

CoreLogic House Price Index – Main Centre Average Value

Although the average property value across Auckland rose in September, the increase was not seen in all sub-markets. Papakura, Manukau, and Rodney all recorded gains, as did Auckland City, but North Shore and Waitakere both edged down 0.1%, and Franklin dipped 0.4%.

“Auckland property remains pricey, whether you’re a first home buyer, investor, or relocating owner-occupier. This will be restraining demand in some locations. But it’s less expensive than it used to be, and this may just be kick-starting activity in other parts of the super-city,” Mr Davidson noted.

Wellington is another key area where some signs of growth have emerged in recent months, but there’s also evidence of continued ‘caution’ too. For example, Porirua’s average property value rose by 1.1% in September, but after increases in the prior month or two, Upper Hutt and Wellington City just eased back again slightly.

“Patchiness is a word I’ve been using quite a bit lately to describe the market at this point in the cycle, and Wellington is a good example of that,” Mr Davidson said.

Regional House Price Index results

Outside the main centres, the changes in property values in September were also a mixed bag. Gisborne, Napier, Invercargill, Hastings, and Whanganui all saw solid increases, but New Plymouth and Whangarei each fell by close to 1%.

Queenstown also saw a drop in average values in September, of 0.4%, leaving it down by 2.8% over the past three months.

“Queenstown remains one of the most resilient parts of the country, but the latest figures are a reminder that it’s not totally bullet-proof either.”

Property market outlook

Given the imminent General Election and possible uncertainty around any subsequent coalition talks, property market indicators could remain ‘jumpy’ for the next month or two, especially when it comes to activity measures such as new listings flows and agreed sales volumes.

“However, once any Election-related disruptions have faded into the background, a clearer upwards trend should become apparent for the property market, with sales and prices rising into 2024. That said, this emerging growth could be pretty muted by past standards, given that housing affordability is still problematic, mortgage rates aren’t set to fall anytime soon, and there’s also still the very real possibility of caps on debt to income ratios next year,” Mr Davidson noted.

“If DTI restrictions become the central expectation, some investors may look to bring forward purchases, if they fear not being able to buy at all after any rule changes. That could make things trickier for first home buyers for a while, after a period where they’ve enjoyed reduced competition from other buyer groups. But after any DTI restrictions are imposed, first home buyers may find conditions more to their liking again,” he concluded.

Download the CoreLogic House Price Index