The pace of decline in New Zealand average property values continued to peter out in August as a number of key sub-markets recorded increases, the CoreLogic House Price Index (HPI) shows.

National values nudged just 0.2% lower in August, with the three-month change also easing to a 1.8% fall. The average property is now worth $905,466, which is 13.2% below the peak (or -$137,795), but still 24.3% ($177,190) higher than March 2020’s ‘pre-COVID’ figure.

CoreLogic NZ Chief Property Economist, Kelvin Davidson said it’s only a matter of time until the national average flattens out or even starts to rise too, with this week’s announcement by the National Party also likely to boost demand if they’re elected.

“Although values have continued to edge lower nationally, the floor is likely to be near, with many of the key fundamental drivers now turning around,” Mr Davidson said.

“It’s notable that mortgage rates are likely to now be close to their peak, although further small changes can’t be ruled out as global markets, and hence wholesale financing costs, remain a little jittery. On top of that, migration has significantly boosted property demand, and labour markets remain robust. We’re also now starting to see the impact of the loosening in the loan to value ratio rules from June 1st flow through to more low-deposit lending for both owner-occupiers and investors with a 35-40% deposit, who were previously locked out.”

“We also need to consider the possibility that National wins the election and pushes through its new housing policies. A shorter Brightline Test may drive increased investment purchases, but also some sales by existing investors, given no/reduced liability for capital gains tax. And while the phased reinstatement of mortgage interest deductibility could boost sentiment, the hard sums might not be altered too much – many purchases would still make big cashflow losses for a start, because rental yields would still be low and mortgage rates high. Of course, existing investors would pay less tax.

“The softened foreign buyer rules could also boost demand and prices, although probably more so in local markets than across NZ as a whole. In Queenstown, for example, about 10% of properties are valued at $2 million plus, and we know it’s already more popular with foreign buyers, who could potentially exacerbate the shortages of stock at ‘affordable’ prices that already exist.

Mr Davidson said that the fading downturn at the national level was mirrored across most of the main centres.

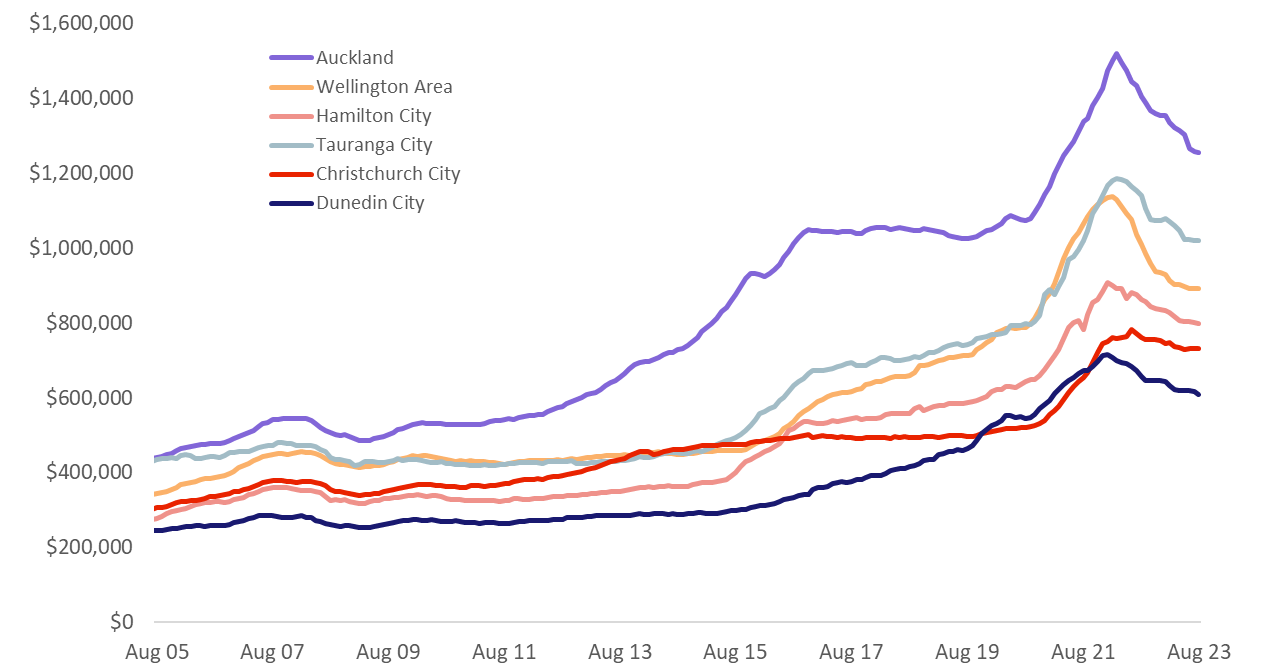

“Auckland, Hamilton, Tauranga and Wellington were all down by only 0.2% or 0.3% in August, and Christchurch actually saw a 0.2% rise in average values. Dunedin’s 1.1% drop was an outlier, but is much more likely to be a blip than a new, weaker trend.

“Some key parts of previously-weak markets are showing signs of renewed property value growth. For example, North Shore and Manukau in Auckland have both recorded two consecutive monthly rises, as have Upper Hutt and Wellington City. These markets aren’t ‘cheap’ by any means, but it would certainly appear that the sharp falls previously seen have brought some buyers back into the fold.”

CoreLogic House Price Index – Main Centre Average Value

After a rise in the average property value across the wider Wellington area in July, the latest figure dipped back a bit again (-0.3%), due to falls in Porirua (-0.4%) and Lower Hutt (-1.2%).

“After the increases in both July and August, average values in Upper Hutt and Wellington City have now edged up by a total of around 0.5% apiece – small in the context of the prior downturn, but of course each cycle has to start somewhere,” Mr Davidson said.

Auckland has been another key part of the country to have seen significant falls in property values during the downturn, but alongside parts of Wellington, is also now hinting at a start of the next phase. Indeed, North Shore and Manukau (both 0.5%) saw their second rise in a row in August, while Franklin also recorded a gain of 1.4%.

“Auckland property remains pricey, whether you’re a first home buyer, investor, or relocating owner-occupier. But it’s less expensive than it used to be, and this may just be kick-starting a bit of demand in some parts of the super-city,” Mr Davidson noted.

Regional House Price Index results

Outside the main centres, property value trends remained a bit patchy in August, as is typically the case at a wider turning point for the market, Mr Davidson said.

For example, Gisborne, Whanganui, and Nelson all saw average values fall by at least 1% in August, with New Plymouth (-0.7%) and Napier (-0.6%) also subdued. But there were only modest falls in Palmerston North, Whangarei, and Rotorua, while Queenstown increased again, Invercargill was up by 0.6%, and the rise in Hastings topped 1%.

Napier, Gisborne, and Palmerston North have all seen double-digit drops in average values over a 12-month horizon, but New Plymouth and Invercargill are only 2-3% down, and Queenstown flat.

Property market outlook

Mr Davidson noted that 2023 always had the potential to be a year of two halves – subdued for a start, but signs of an upturn later – and this is coming to fruition.

“However, the next phase for the market still looks likely to be slow and patchy, rather than the rampant upturn we saw over 2020-21. After all, the volume of sales is rising from a very low base of less than 60,000 annually, and it may be quite some time until purchasing activity returns to ‘normality’, which is around 90-95,000 sales per annum. Affordability is still challenging, mortgage rates are set to be ‘higher for longer’, and debt to income ratio caps for mortgage lending remain on the cards for 2024 – all factors which could help to contain any major market exuberance.

“In that environment, buyers won’t feel excessive pressure to secure a deal before somebody else does, in turn keeping some kind of lid on price growth. Granted, ‘animal spirits’ can drive faster growth in values than the underlying drivers would suggest is likely, but psychology will likely have a lesser role to play when mortgage rates are 7% and those real cash outgoings to service debt each week are high.

Download the CoreLogic House Price Index