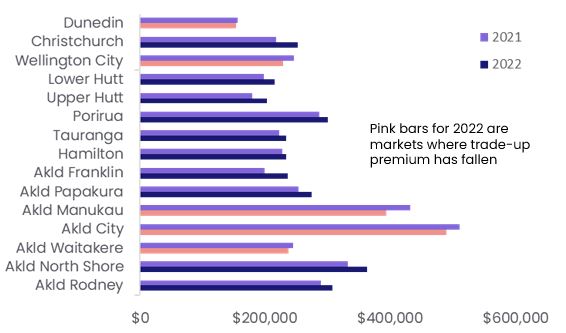

It’s still quite a big financial hurdle to move to a property with more bedrooms in most parts of the country – and in fact, it’s actually got worse in some places in recent months. However, in areas such as Auckland City, Waitakere, Manukau, Wellington City and Dunedin, the gap in median values between three- and four-bedroom properties has started to drop. This reinforces the fact that most people ‘buy and sell in the same market’ and a wider downturn can sometimes be a good time to try and climb the ladder.

A regular Pulse topic we return to each year is the gap in median values between three- and four-bedroom properties – a kind of proxy for the cost to ‘trade up’ the ladder. Of course, it needs to be acknowledged up front that bedroom count is not a perfect measure of ‘starter’ vs ‘second’ homes, or of quality or suitability for each individual/household – but it nevertheless reveals some pretty interesting patterns.

The last time we looked at this was June last year, and at that time the post-COVID environment hadn’t made it any easier to trade up – the gap was still at least $150k across each of the main centres, and it had generally increased quite sharply from mid-2020, amidst the wider upswing in values across the market over that period. We suggested the rise in the trade-up premium could have been one reason why many would-be movers were instead staying put (and maybe renovating), which in turn could have been blocking access for some first home buyers.

So how do things look another year on? From the point of view of a buyer looking to trade up, the news is broadly positive. Last year’s momentum has certainly vanished, with all key areas seeing a

smaller rise in the trade-up premium over the past 12 months than in the previous period – consistent with the change in wider market conditions we’ve seen lately.

To be fair, even though the % change in median values for four-bedroom properties has generally been the same or smaller than the figure for three-bedroom properties over the past 12 months (and four-bedroom values have actually dropped outright over that horizon in Auckland City, across wider Wellington, and Dunedin), the fact they start at a higher level means the $ increase in the trade-up gap has still been >$30,000 in Auckland North Shore, Franklin, and Christchurch.

But even so, there have been ‘fallers’ too – with the trade-up premium shrinking over the past year in Auckland City, Waitakere, Manukau, Wellington City, and Dunedin (see the first chart). The margin is still about $400,000 or more in areas such as Auckland City and Manukau, but at least it’s fallen. Of these areas, Dunedin has the smallest trade-up premium, at $154,000, down a touch from $156,000 a year ago (but still higher than $141,000 two years ago).

Difference in median property values: four minus three-bedroom properties

(Source: CoreLogic)

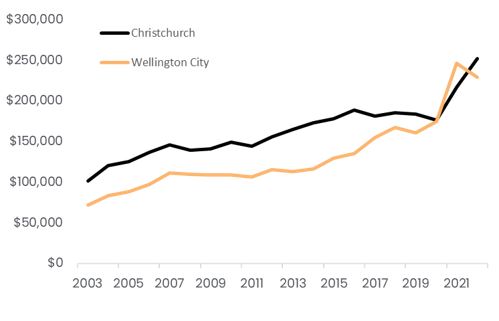

It’s also interesting to look at a long-run comparison between an area such as Wellington City (where the market boomed from 2015 to 2021 but has since dropped sharply) and the ‘steadier’ Christchurch market. As the second chart shows, Christchurch’s trade-up premium was consistently higher than Wellington’s (even though values themselves are lower in Christchurch), but also that the gap closed in 2020, and then Wellington’s premium went above Christchurch’s for the first time last year. However, ‘normal service’ has resumed this year as Wellington’s premium has dropped but Christchurch’s has continued to rise.

Trade-up premium

(Source: CoreLogic)

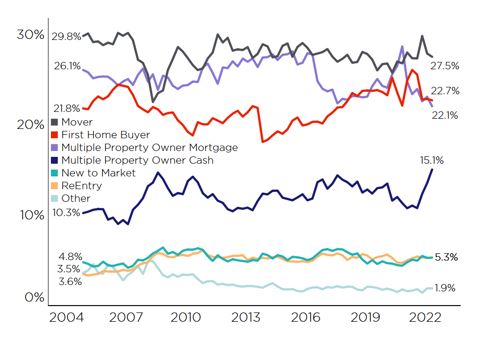

So what are some overall implications from this? Clearly, it still involves quite a bit more equity (and presumably debt in many cases too) to move from a three- to four-bedroom property in most parts of the country. Aside from Dunedin, the gap is at least $202,500 (Upper Hutt) in each of the other markets covered here, and at least $300,000 in Porirua, Rodney, North Shore, Manukau, and Auckland City. And of course, with higher mortgage rates, there’s an increased regular debt servicing burden too. It may well be these still-high costs to shift house have been a factor behind the recent dip in the % share of property purchases going to movers (relocating owner-occupiers) – see the third chart.

That said, it wouldn’t be a surprise to see the trade-up gap generally continue to shrink in the coming months – given any particular % fall across the market as a whole translates into a bigger $ fall on higher value stock (e.g. four-bedroom properties). In other words, that will make trading up a little easier, especially with more listings and choice now available too.