The latest Reserve Bank mortgage lending data shows overall activity remains subdued, with interest-only lending drifting lower, albeit there has been a bit of a respite for new low-deposit borrowers in the past few months.

As we get into the second half of 2022, the wave of existing borrowers rolling off their previous lower mortgage rates and onto sharply higher rates is a key factor to keep an eye on.

Given we already knew property sales volumes remained low in May, it was no surprise that today’s aggregated mortgage lending data from the Reserve Bank (RBNZ) also showed a weak level of activity last month. Indeed, the total value of gross lending – which covers new loans but also top-ups and bank switches – was $6.8 billion, down by $2.1 billion (23.6%) from the same month last year. If anything, the number of loans has been even weaker in recent months.

The falls in lending activity lately have reflected weakness for both owner-occupiers and investors, which reflect CoreLogic’s May Buyer Classification data .

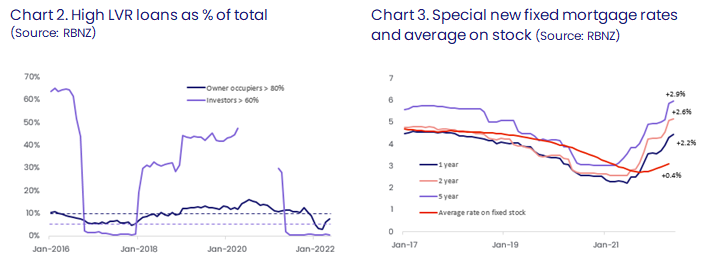

Meanwhile, the latest RBNZ figures also show a split by loan type, i.e. interest-only (IO) versus principal repayments, and there have been some really interesting trends here lately, too.

As the first chart shows, the share of IO loans amongst the new lending flow has been relatively stable for investors in the past 3-6 months but drifting lower for owner-occupiers, and both are lower than in the past – e.g. 40% recently for investors, compared to >50% in mid-2015.

Moreover, IO lending has been on a gradually declining trend amongst the existing stock of loans too, as it becomes a bit harder to get a new IO loan but also existing borrowers are switched to a principal repayment schedule. Some of this may have been a choice too – in particular, as mortgage interest deductibility is phased out for investors, there is now a stronger incentive to reduce the size of the loan at a faster rate.

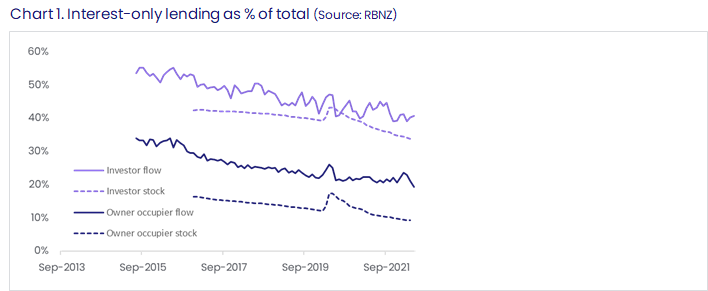

As per usual, a lot of our focus is on the breakdown by loan-to-value ratio (LVR), and this month was another fascinating result. After a bounce-back in April, the share of lending to owner-occupiers at a high LVR (or <20% deposit) continued to increase in May, from 6.1% to 7.7% – a five-month high (see the second chart). From a bank’s perspective, that may now be getting uncomfortably close to the mandated 10% speed limit, and indeed ANZ has recently announced a temporary pause on high LVR loans. As such, it wouldn’t be a surprise to see this figure drop from 7.7% in the next few months.

Of course, it’s not just the supply of mortgage credit that has been tightening up lately, it’s also obviously the cost. As the third chart shows, ‘special’ (high equity) new mortgage rates (from RBNZ data) have risen sharply from their trough – up by 2.2% on a one-year rate, and by 2.9% on a five-year rate – with more increases likely to be seen in the coming months, too.

But even that’s only part of the story. With about 48% of existing loans (by value) currently fixed but due to reprice in the next 12 months (and 12% floating), the full effect of higher mortgage rates is yet to be felt. Indeed, as the third chart also shows, the effective mortgage rate that currently applies on existing loans is still a low 3.1% and has only risen by 0.4%. But that will change markedly in the next 12 months as those existing loans are repriced.

To be fair, there are plenty of doubts circling that the official cash rate will need to rise all the way from 2% to 4%, as the RBNZ is currently indicating. This is because the economy may start to weaken much sooner, and this would tend to pull down inflation to some degree (not to mention put some upwards pressure on unemployment). In addition, a slower overall property market means that banks are likely to have a keen eye on market share, with these competitive pressures also potentially capping the extent to which mortgage rates might ultimately rise.

Even so, there are clearly still some testing times ahead for mortgaged households, as well as the wider economy and property market. A key theme for the next year or so will be that combination of the refinancing wave hitting up against higher mortgage rates themselves. Property buyers with a greater equity/cash base may continue to see opportunities.