Featured news

See all

Modest value growth in NZ property re-emerges in June

Property values in Aotearoa New Zealand ticked up by +0.2% in June, reversing two minor monthly falls of -0.1% apiece in April and May, according to Cotality NZ's latest hedonic Value Index...

Reports

See all

Housing Chart Pack

The Housing Affordability Report analyses the relationship between property values and household incomes, saving a deposit, mortgage serviceability and rental rates relative to household incomes.

Top Performing Lead Generation Call Scripts Top Performing Lead Generation Call Scripts

Product News

See all

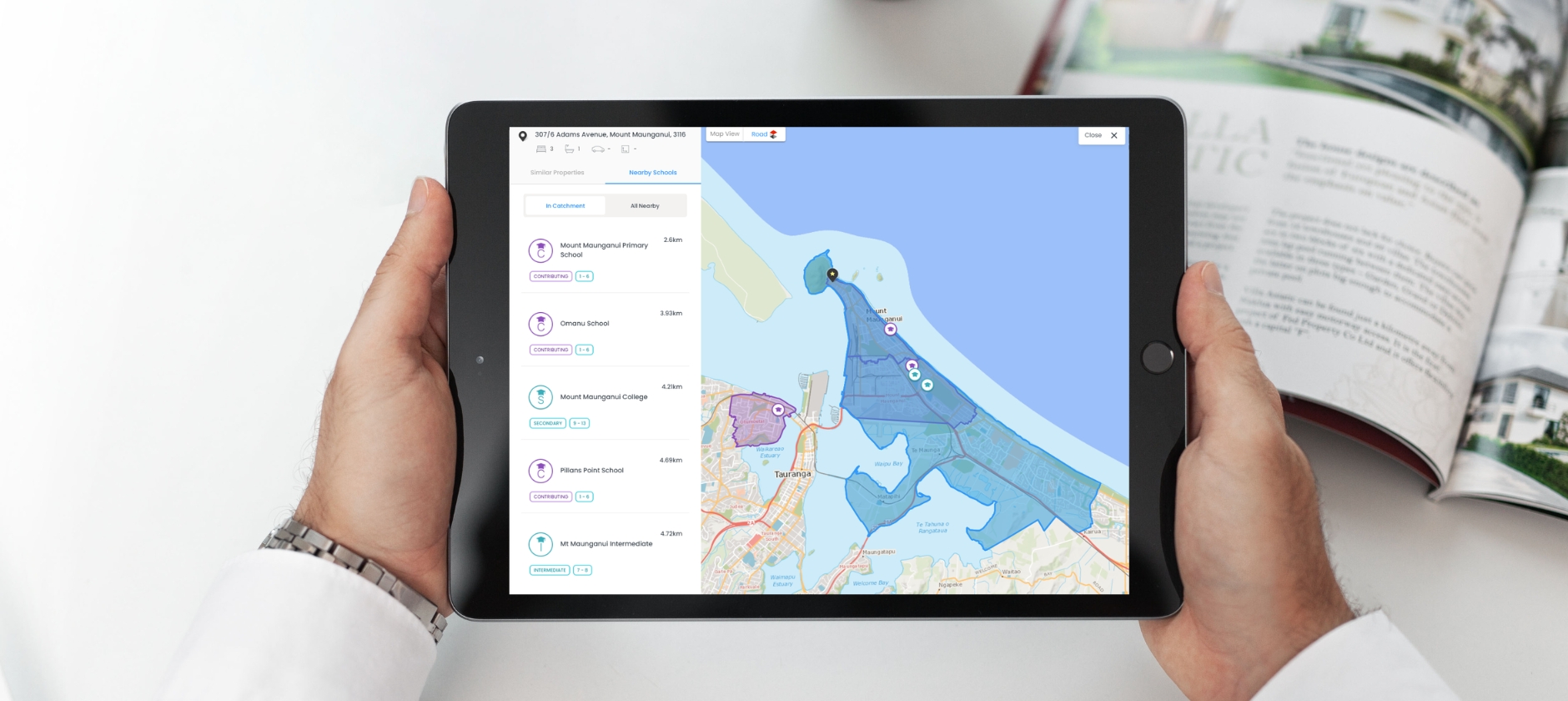

Titles Transaction Report, School Catchments and Flood Zones – All Now Available in Property Guru

When it comes to property decisions, having the right information at your fingertips can make all the difference. That's why the latest updates to Property Guru are designed to help you work...