Intelligent property valuations

Deeper insightsAdvanced machine learning unearths deepe...

Deeper insightsAdvanced machine learning unearths deepe...Advanced machine learning unearths deeper data insights, quickly and efficiently.

Highly predictiveUnderpinned by an ensemble of sub-models...

Highly predictiveUnderpinned by an ensemble of sub-models...Underpinned by an ensemble of sub-models to tap into multiple market dynamics.

Responsiveness calibrationRapid, frequent and continuous recalibra...

Responsiveness calibrationRapid, frequent and continuous recalibra...Rapid, frequent and continuous recalibration keeps pace with market fluctuations.

Extensive coverageBuilt on trusted property data, our AVM ...

Extensive coverageBuilt on trusted property data, our AVM ...Built on trusted property data, our AVM offers over 96% residential property coverage.

Relied on by industry leaders

Thanks to its quality-assured real-time data, our premier AVM helps property professionals make smarter property decisions and grow their business.

Our AVM is a digital alternative to traditional full market valuations. It can help reduce operating costs, boost efficiency and reach the right valuation lending decision sooner.

By using detailed and current data to originate loans, you can also pre-qualify leads to improve loan approval rates and minimise financial risks.

Join thousands of real estate agents winning new business every month as they demonstrate their property market knowledge and expertise.

Our Comparative Market Analysis (CMA) reporting tool powered by the CoreLogic AVM provides trusted, independent property value estimates that you can use to start your listing conversations.

Educate, inform and empower your clients when they’re looking to buy or refinance. By providing superior service, you’ll be able to win repeat business and grow your referral base.

Knowing the accurate, current value of a potential investment property is critical.

Powering both Property Guru and the propertyvalue.co.nz website, our AVM helps investors stay on top of the latest price movements so they can make sound investment decisions.

Relied on by industry leaders

Thanks to its quality-assured real-time data, our premier AVM helps property professionals make smarter property decisions and grow their business.

Our AVM is a digital alternative to traditional full market valuations. It can help reduce operating costs, boost efficiency and reach the right valuation lending decision sooner.

By using detailed and current data to originate loans, you can also pre-qualify leads to improve loan approval rates and minimise financial risks.

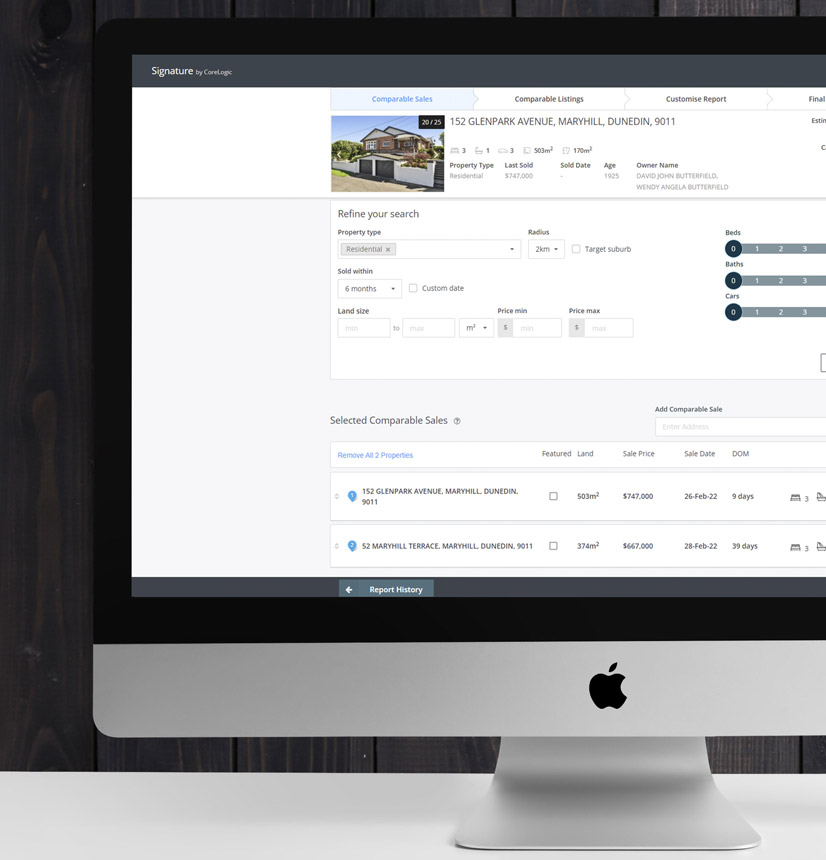

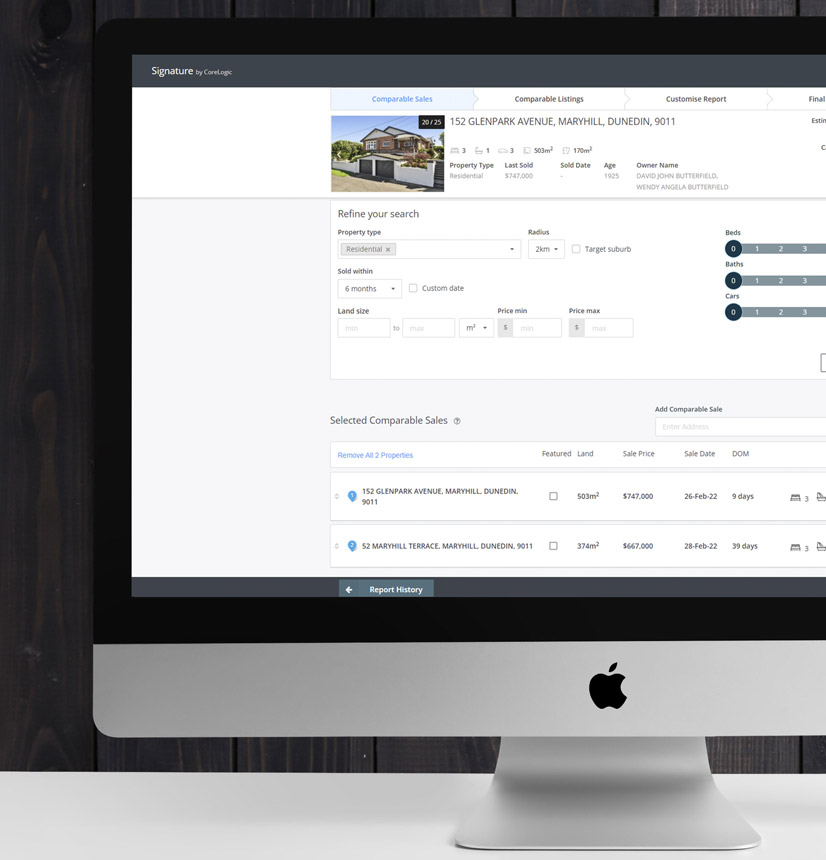

Join thousands of real estate agents winning new business every month as they demonstrate their property market knowledge and expertise.

Our Comparative Market Analysis (CMA) reporting tool powered by the CoreLogic AVM provides trusted, independent property value estimates that you can use to start your listing conversations.

Educate, inform and empower your clients when they’re looking to buy or refinance. By providing superior service, you’ll be able to win repeat business and grow your referral base.

Knowing the accurate, current value of a potential investment property is critical.

Powering both Property Guru and the propertyvalue.co.nz website, our AVM helps investors stay on top of the latest price movements so they can make sound investment decisions.

Automated valuations at your fingertips

CoreLogic’s AVM provides powerful, real-time estimates of residential property values across many of our featured products and solutions:

Automated valuations at your fingertips

CoreLogic’s AVM provides powerful, real-time estimates of residential property values across many of our featured products and solutions:

AI-powered analytics and cloud computing bring insights to the surface with speed and efficiency.

Our indices are the go-to measure of the housing market. When Kiwis think ‘property prices’ they are often informed by our flagship house price index. Regularly quoted, highly respected, and driven by proven methodologies, our indices are as widely trusted as they are quoted.

The digital world has radically changed customers’ home-buying expectations.

To keep ahead of the curve, CoreLogic helps simplify the mortgage process for lenders by offering a seamless end-to-end experience - helping make lending faster, simpler, more cost effective - and most importantly, improving the customer experience.

Supercharge your engagement strategies with dynamic, digital property reports that showcase valuable information on the properties your clients are interested in as they undertake their property search.