Showing 31-45 out of 283 results

Decoding real estate 2025 data-driven insights and strategies ...

In real estate, every lead, appraisal, listing, and negotiation counts, not just for closing deals but for running a profitable ...

Top Performing Lead Generation Call Scripts

To help you increase the effectiveness of your call sessions, download our eBook providing valuable insights and actionable ...

Housing market close to a trough

Property values in Aotearoa New Zealand edged -0.1% lower in January, marking the fifth month in a row with limited movement.

Monthly Housing Chart Pack - January 2025

Here are the must know stats, facts and figures on New Zealand's residential property market.

To fix or not to fix: Mortgage rate decisions a key theme for ...

In recent months, falls in mortgage rates have understandably meant there’s been a strong focus on the ‘short end’ of the curve, ...

Construction conditions look set to improve in 2025

The cost to build a ‘standard’ single storey three bedroom, two-bathroom standalone dwelling* in NZ increased by 0.6% in the three ...

Home value decline in December sums up 2024

Property values in Aotearoa New Zealand fell -0.2% in December, marking the ninth drop in the past 10 months, according to ...

Conflicting forces to shape New Zealand’s property market in 2025

New Zealand’s property market is approaching 2025 with a mix of challenges and opportunities, as lower mortgage rates contend with ...

Best of the Best 2024 unveils a year of contrasts

Despite a challenging year for New Zealand’s property market, moments of resilience and divergence still emerged, with ...

Investing in your success: New Property Guru’s latest updates

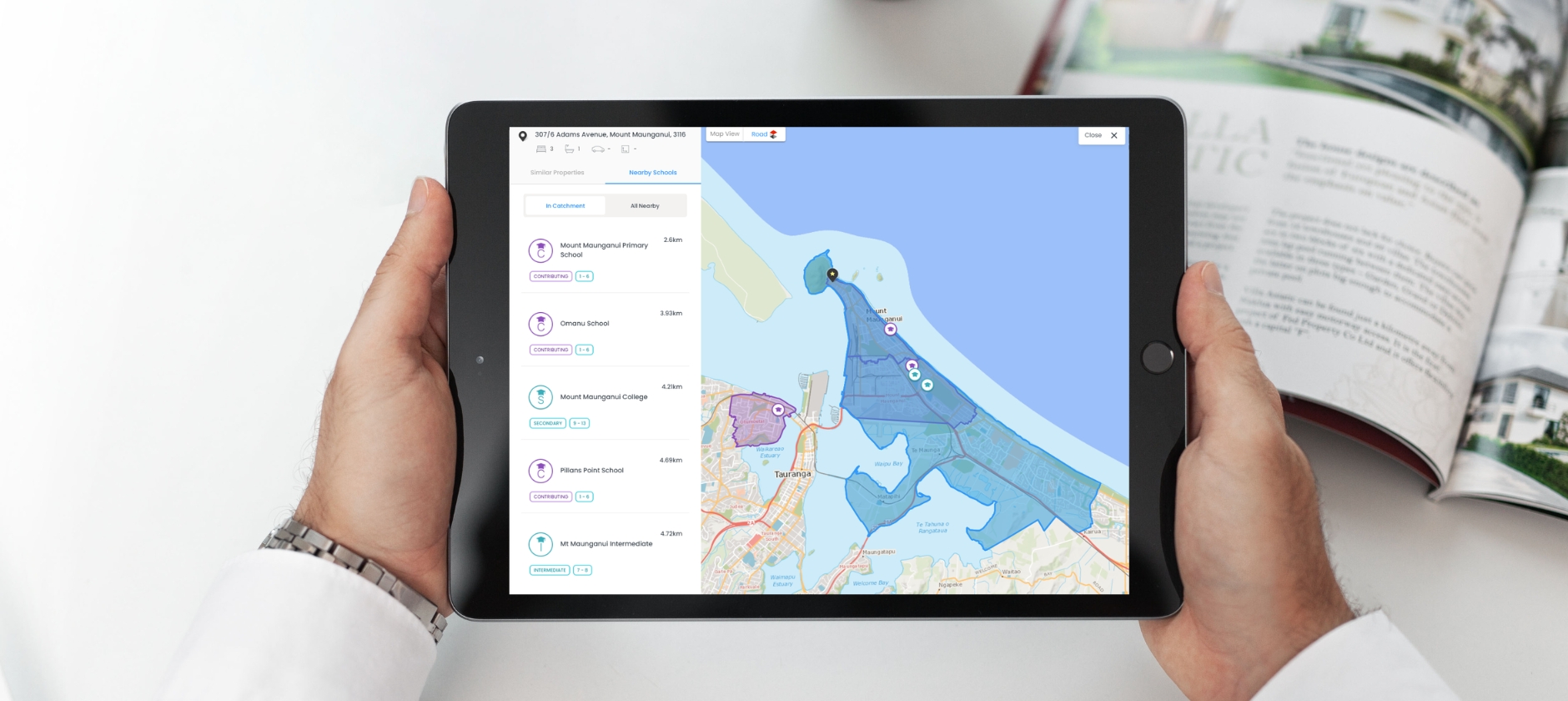

As we approach the end of 2024, this has been a transformative year for the new Property Guru. Our commitment to continually ...

‘Holding pattern’ continues for property values in November

Property values in Aotearoa New Zealand fell 0.4% in November, marking the ninth consecutive decline, according to CoreLogic's ...

OCR cut again and more to come

The financial markets and bank economists were unanimous in expecting the Reserve Bank to cut the official cash rate by 0.5% to ...

DTIs: A significant change, but not a deal-breaker

Debt-to-income rules will play a bigger role as mortgage rates fall, as some would-be buyers navigate a new reality.There are ...

Investors on the rebound and first home buyers still strong ...

New Zealand’s property market continues to present mixed signals, with sales volumes rising yet the overall level of activity ...

More property sellers face losses amidst weak market

New Zealand’s property market remains subdued, with a rising share of sellers incurring losses amid higher listing volumes, falling ...