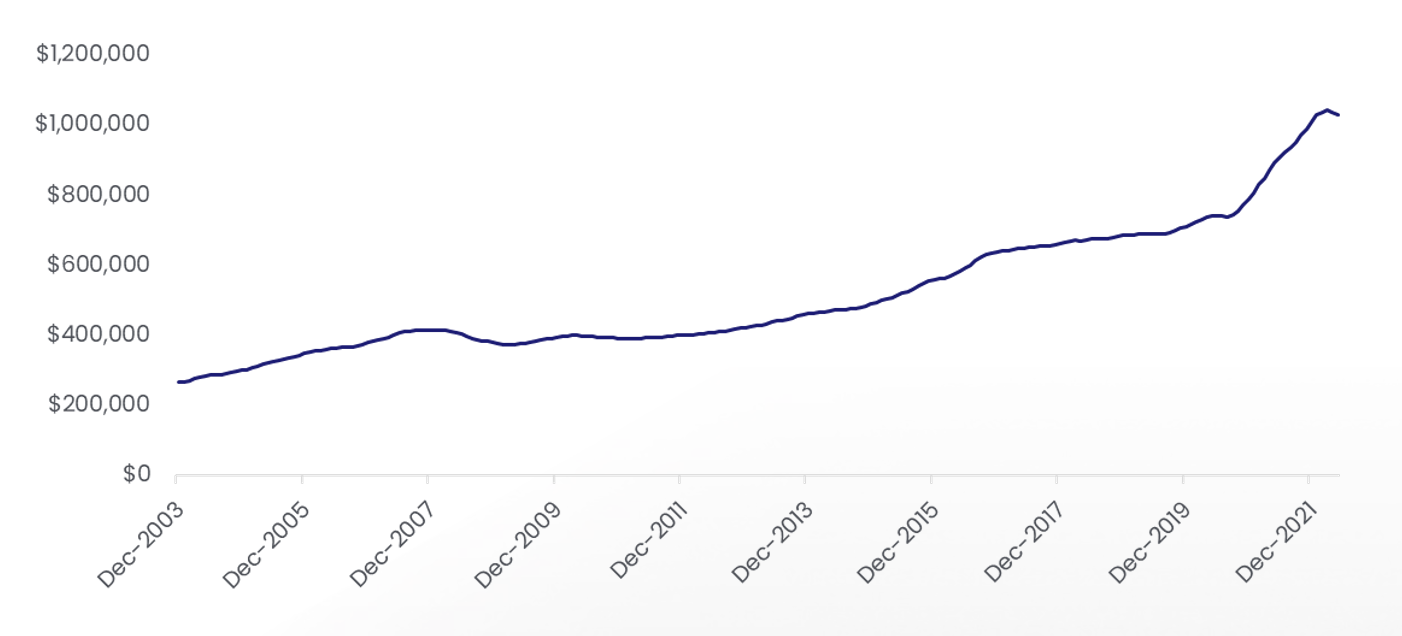

Since December 2003 (i.e. almost 20 years ago), the national average property value has risen from $263,562 to $1,027,121 – an increase of $763,559, or a cumulative 290%. That represents an annual average increase per year of around 7.5%.

This is shown in Figure 1, with the CoreLogic House Price Index covering all residential properties (not just those that have recently sold) and providing an average value at each point in time.

Generally the market has been on a consistently rising trend for most of this period, apart from a downturn around the time of the GFC and a slow rebound in the 4-5 years thereafter, while the post-COVID period has seen a very sharp spike in property values now giving way to the early stages of a correction. A key underlying trend through all of this has been the long-term declines in mortgage rates and the more relaxed credit environment, albeit both of those factors have now gone into reverse.

Figure 1. Cumulative growth in the national average property value – CoreLogic House Price Index

Since 2003, amongst the main centres, Hamilton has seen the largest increase in average property values, of 330% - followed by Dunedin at 298%, Auckland 287%, Wellington 282%, Tauranga 277%, and Christchurch 236%. The latter has seen slower growth due to the post-earthquakes surge in new housing supply, but with signs now apparent that this supply reaction is slowing down, Christchurch could see outperformance over the coming years (even if that only means smaller falls in the near term).

In the present day, we’re now clearly into a correction phase for the NZ housing market, with values set to drop by perhaps 10% from peak to trough, if not a little more than that. Then longer term, a generally tighter credit environment in future – e.g. loan to value ratio rules, possible debt to income ratio limits - and higher interest rates than we’ve seen in recent years (alongside more restrictive migration settings) could cap the rate of capital growth.

That would help to alleviate some affordability pressure for would-be first home buyers, but may also bring into question the economics of being an investor. After all, with less capital growth, low yields, and higher interest rates (as well as increased tax bills), overall returns would be reduced, and cashflow wouldn’t be as favourable either.