- Asset Name: Property values rise 0.4% to kick off 2024

- Overview Text: The CoreLogic House Price Index rose for the fourth month in a row in January, although the 0.4% increase was a deceleration in the pace of gains on both November (0.7%) and December (1.0%).

- Image:

- Asset Name: Unlocking Real Estate Success: Using SMS to overcome contact disengagement

- Overview Text: Did you know that 97.5% of contacts in agency CRMs haven’t had a connected phone call in the last 12 months?*That means there is a wealth of potential vendors already existing in your CRM which haven’t been tapped in to. With time constraints and being constantly on the move, it is challenging to stay connected with clients, which in turn can hinder your prospecting efforts and result in missed opportunities. But what if there was a solution?

- Image:

- Asset Name: First home buyers climb property ladder with record-high purchases

- Overview Text: While the General Election results are set to draw a ‘line in the sand’ for investors, first home buyers (FHBs) continue to lead the market with nearly 28% of property purchases in September, a record-high.

- Image:

- Asset Name: Investor rental returns still need topping up to cover the mortgage

- Overview Text: Despite record increases in rents, New Zealand property investors are grappling with a notable disparity between gross yields and mortgage repayments, requiring them to seek alternative sources of income.

- Image:

- Asset Name: Boosting fixed income: How agents are growing their rent roll with new property management leads

- Overview Text: With the market fluctuations seen across the industry over the last year, more agencies are turning their attention to their Property Management teams, securing stable revenue to help support business operations and growth.

- Image:

- Asset Name: Property sale volumes remain erratic

- Overview Text: High mortgage rates continue to pressure the housing market, contributing to patchy volumes month to month, and January sales activity reaching its second lowest level in about 40 years, according to CoreLogic's February Housing Chart Pack.

- Image:

- Asset Name: No OCR change… for now

- Overview Text: Chief Property Economist Kelvin Davidson unpacks the February cash rate decision and Monetary Policy Statement, and what it means for the housing market.

- Image:

- Asset Name: Soft start to 2024 extends into February

- Overview Text: National home values rose 0.3% in February, continuing the decelerating trend seen since December, CoreLogic's House Price Index shows.

- Image:

- Asset Name: Pay gap a challenge for NZ’s female property investors

- Overview Text: Female-only real estate investors significantly lag their male counterparts in fast-tracking wealth creation through property, an analysis of New Zealand’s home ownership reveals.

- Image:

- Asset Name: Housing recovery spreads to nearly 60% of NZ suburbs

- Overview Text: Property values rose in almost three-fifths (58.7%) of New Zealand suburbs over the past three months, illustrating the slow and steady spread of the country’s market recovery.

- Image:

- Asset Name: Kiwi households face ongoing affordability squeeze

- Overview Text: Housing affordability has improved in NZ since late 2021, but it remains stretched, and recent house price rises as well as high interest rates continue to add strain on Kiwi households, according to the latest CoreLogic Housing Affordability Report.

- Image:

- Asset Name: Soft start for NZ housing market in March quarter

- Overview Text: CoreLogic's House Price Index rose 0.5% in March, similar to January and February's muted gains, taking values 1.1% higher over the first quarter of 2024.

- Image:

- Asset Name: The new-build premium could be about to shrink

- Overview Text: In today's Market Pulse, CoreLogic Chief Property Economist Kelvin Davidson explores if a new-build premium exists, and its outlook.

- Image:

- Asset Name: Normalisation of NZ construction costs to provide certainty for builders and consumers

- Overview Text: The growth rate of construction costs in New Zealand has dropped below long-term averages, as the industry completes a wave of building consents and resolve COVID-19 supply chain disruptions.

- Image:

- Asset Name: Business as usual for cash rate and housing market

- Overview Text: Chief Property Economist Kelvin Davidson unpacks the latest OCR decision and what it means for the housing market.

- Image:

- Asset Name: The agent’s guide to social media ad success

- Overview Text:

- Image:

- Asset Name: Borrowers bet on rate cuts by locking in short-term mortgages

- Overview Text: Kiwi borrowers are betting on possible rate cuts, with the proportion of short-term fixed mortgages reaching record levels in February.

- Image:

- Asset Name: First home buyer market share stays strong with outlook favourable

- Overview Text: In today's Pulse, Chief Property Economist Kelvin Davidson discusses the sustained growth in first home buyer activity, including the outlook and market share of other buyer groups (mortgaged MPOs, movers, etc).

- Image:

- Asset Name: House prices flatten in April

- Overview Text: Home value growth in Aotearoa New Zealand stalled in April, with the 0.1% dip indicative of the indecisive nature of the property market at present.

- Image:

- Asset Name: ‘Movers’ could be a group to watch

- Overview Text: The surge in available listings in New Zealand’s residential housing market is reshaping buyer options, with relocating owner-occupiers (movers) showing early signs of a comeback.

- Image:

- Asset Name: Monthly Housing Chart Pack - February 2025

- Overview Text: Here are the must know stats, facts and figures on New Zealand's residential property market.

- Image:

- Asset Name: Using data to shorten response time during a natural disaster

- Overview Text: Discover how lenders and government leveraged CoreLogic data and satellite imagery during the recent weather emergencies, and how we can help organisations plan for, and respond to, future weather events.

- Image:

- Asset Name: Insights from the field: 10 things to know about the property market right now

- Overview Text: In today's Pulse article, Chief Property Economist Kelvin Davidson provides 10 insights into the current property market, including attitudes towards rule changes, regional disparities, and buyer sentiment across the country.

- Image:

- Asset Name: Low deposit mortgages help fuel first home buyer activity

- Overview Text: First home buyers (FHBs) continue to maintain near-record market share even as they battle affordability constraints, according to CoreLogic’s August Housing Chart Pack.

- Image:

- Asset Name: 10 things to know about the mortgage market right now

- Overview Text: In today's Pulse article, Kelvin Davidson analyses the current mortgage lending environment in New Zealand.

- Image:

- Asset Name: Auckland leads slowdown, as national prices dip again

- Overview Text: Home value growth in Aotearoa New Zealand has completely petered out in the past two months, with values dipping by 0.2% in May, after a minor 0.1% fall in April.

- Image:

- Asset Name: Property market recovery is losing steam

- Overview Text: Falling property values across a growing number of New Zealand suburbs over the past three months highlights an emerging dip in market momentum.

- Image:

- Asset Name: Persistent market challenges, despite easing lending and tax rules

- Overview Text: As New Zealand’s property market shows a modest recovery in sales volumes, the broader picture indicates activity remains subdued, with listings at elevated levels and prices flattening off.

- Image:

- Asset Name: 4 x Townhouses Sold from a Digital Campaign

- Overview Text: Gus asked Plezzel to create a digital advertising campaign that featured the key attributes of the development including the high-quality design, proximity to the CBD, and stamp duty savings, and targeted the right buyers.

- Image:

- Asset Name: Brighter future for small investors and relocating owner-occupiers as market conditions shift

- Overview Text:

- Image:

- Asset Name: Investing in your success: New Property Guru’s latest updates

- Overview Text: As we approach the end of 2024, this has been a transformative year for the new Property Guru. Our commitment to continually improving and investing in the platform reflects our dedication to adding value and helping people build better lives.

- Image:

- Asset Name: Raft of policy changes unlikely to shift subdued market

- Overview Text: Amidst a raft of policy changes, the renewed weakness in Aotearoa New Zealand's home values continued in June.

- Image:

- Asset Name: Tiny hints of easier monetary policy down the track?

- Overview Text: Chief Property Economist Kelvin Davidson unpacks the July cash rate decision and what it means for the housing market.

- Image:

- Asset Name: Sale volumes drop in June, but first home buyers maintain strong presence

- Overview Text: As high mortgage rates continue to dampen buyer demand in New Zealand’s housing market, residential property sales weakened in June, after a 13-month growth streak, according to CoreLogic’s July Housing Chart Pack.

- Image:

- Asset Name: What’s behind NZ’s townhouse boom?

- Overview Text: Chief Property Economist Kelvin Davidson explores the driving forces behind New Zealand’s decade-long house-building boom.

- Image:

- Asset Name: Property values down 2.5% from cyclical peak

- Overview Text: CoreLogic's updated, hedonic Home Value Index (HVI) showed a 0.5% fall in values across NZ in July - the fifth monthly fall in a row - taking the total decline from February's 'mini peak' to 2.5%.

- Image:

- Asset Name: Resale profits decline as buyer bargaining power gains momentum

- Overview Text:

- Image:

- Asset Name: Top Performing Lead Generation Call Scripts

- Overview Text:

- Image:

- Asset Name: Slowing rate of decline signals potential value floor

- Overview Text: Property values in New Zealand fell -0.5% in October according to CoreLogic's hedonic Home Value Index (HVI) - the eighth drop in a row. This takes the total decline in values since February to -5.1%.

- Image:

- Asset Name: NZ construction costs fall for the first time in more than a decade

- Overview Text: New Zealand's residential construction industry experienced its first recorded drop in the cost to build a new house in at least 12 years, with the latest Cordell Construction Cost Index (CCCI) revealing a 1.1% decrease in the three months to June.

- Image:

- Asset Name: OCR down again as mortgage rates set to keep falling

- Overview Text:

- Image:

- Asset Name: CoreLogic NZ launches powerful new property market insights product

- Overview Text: CoreLogic NZ has unveiled a new property market insights product that provides extensive insights into the country's residential housing landscape using detailed and comprehensive data sources.

- Image:

- Asset Name: NZ property market faces mixed fortunes as recent slowdown hits suburbs

- Overview Text:

- Image:

- Asset Name: Monthly Housing Chart Pack - September 2024

- Overview Text: Here are the must know stats, facts and figures on New Zealand's residential property market.

- Image:

- Asset Name: Where are Aotearoa NZ’s $1 million+ housing markets?

- Overview Text: In today's Pulse article, Head of Research Nick Goodall dives into Aotearoa NZ’s $1 million+ housing markets.

- Image:

- Asset Name: Rate cuts haven’t pumped up house prices yet

- Overview Text: CoreLogic's hedonic Home Value Index (HVI) showed another subdued month for the property market in September, with values down by a further 0.5%. That was the seventh monthly fall in a row.

- Image:

- Asset Name: Difficult mortgage decisions for borrowers likely to continue

- Overview Text:

- Image:

- Asset Name: NZ construction costs show minor uptick amidst ongoing industry slowdown

- Overview Text: Tax changes, high levels of existing stock on the market, and credit-constrained buyers have compounded the building industry slowdown, holding construction cost growth low for more than 18 months.

- Image:

- Asset Name: ‘Holding pattern’ continues for property values in November

- Overview Text: Property values in Aotearoa New Zealand fell 0.4% in November, marking the ninth consecutive decline, according to CoreLogic's hedonic Home Value Index (HVI).

- Image:

- Asset Name: Lower interest rates may take time to ripple through the housing market

- Overview Text: CoreLogic's Home Value Index (HVI) showed that the property market remained weak in August, with values down by another 0.5%. That was the sixth consecutive fall since February’s ‘mini peak’.

- Image:

- Asset Name: Investors take a fresh look at the NZ property market

- Overview Text: Mortgaged multiple property owners (MPOs) remain less active than usual, but there are early signs that some are starting to return – a signal that ‘mum and dad’ investors might be starting to see value in the NZ property market again.

- Image:

- Asset Name: First Home Buyers capitalise on soft market

- Overview Text:

- Image:

- Asset Name: More property sellers face losses amidst weak market

- Overview Text: New Zealand’s property market remains subdued, with a rising share of sellers incurring losses amid higher listing volumes, falling house prices, and persistent economic challenges.

- Image:

- Asset Name: Investors on the rebound and first home buyers still strong in sluggish market

- Overview Text:

- Image:

- Asset Name: DTIs: A significant change, but not a deal-breaker

- Overview Text:

- Image:

- Asset Name: OCR cut again and more to come

- Overview Text:

- Image:

- Asset Name: OCR drops, but may not impact housing too much

- Overview Text: Chief Property Economist Kelvin Davidson unpacks the August cash rate decision and Monetary Policy Statement.

- Image:

- Asset Name: Reserve Bank sticks firmly to the script

- Overview Text: Chief Property Economist Kelvin Davidson unpacks the February cash rate decision and Monetary Policy Statement, and what it means for the housing market.

- Image:

- Asset Name: New suburb-level property insights as NZ housing market turns a corner

- Overview Text:

- Image:

- Asset Name: Subtle turning point for property sellers

- Overview Text: New Zealand’s property market is showing early signs of a gentle turnaround, giving resellers a glimmer of renewed leverage after a prolonged downturn.

- Image:

- Asset Name: The next upturn is slowly building

- Overview Text: Property values in Aotearoa New Zealand rose by +0.5% in March, after a +0.4% lift in February, and a flat result for January.

- Image:

- Asset Name: To fix or not to fix: Mortgage rate decisions a key theme for 2025

- Overview Text:

- Image:

- Asset Name: Monthly Housing Chart Pack - January 2025

- Overview Text: Here are the must know stats, facts and figures on New Zealand's residential property market.

- Image:

- Asset Name: Housing market close to a trough

- Overview Text: Property values in Aotearoa New Zealand edged -0.1% lower in January, marking the fifth month in a row with limited movement.

- Image:

- Asset Name: Decoding real estate 2025 data-driven insights and strategies from real estate agents

- Overview Text: In real estate, every lead, appraisal, listing, and negotiation counts, not just for closing deals but for running a profitable business. To stay ahead in a tough market, you need clear insights that inform, help you act decisively and deliver results.

- Image:

- Asset Name: First home buyers well placed for 2025

- Overview Text:

- Image:

- Asset Name: NZ residential construction cost growth slows to near-record low

- Overview Text:

- Image:

- Asset Name: Home value decline in December sums up 2024

- Overview Text:

- Image:

- Asset Name: Getting the OCR down quickly

- Overview Text: Chief Property Economist Kelvin Davidson unpacks the February cash rate decision and Monetary Policy Statement, and what it means for the housing market.

- Image:

- Asset Name: Gender pay gap and investment divide holding women back from property wealth

- Overview Text: New Zealand women remain under-represented in investment property ownership, with financial barriers rather than attitudes holding them back, CoreLogic’s latest Women & Property Report 2025 reveals.

- Image:

- Asset Name: NZ property values return to growth in February

- Overview Text: Property values in Aotearoa New Zealand rose by +0.3% in February, the clearest sign yet that 2024’s ‘mini downturn’ has come to an end and that 2025 will likely see modest growth.

- Image:

- Asset Name: NZ housing not cheap, but affordability shows signs of improving

- Overview Text: New Zealand’s housing affordability has improved to its best level since 2019 on some measures, with falling property values, rising incomes, and, most recently, lower mortgage rates easing affordability pressures.

- Image:

- Asset Name: Monthly Housing Chart Pack - March 2025

- Overview Text: Here are the must know stats, facts and figures on New Zealand's residential property market.

- Image:

- Asset Name: Meet Cotality: CoreLogic Embraces a New Name and Bold Vision for the Future of the Property Industry

- Overview Text:

- Image:

- Asset Name: Tariff uncertainty keeps OCR ‘downward bias’ in place

- Overview Text: Chief Property Economist Kelvin Davidson unpacks the February cash rate decision and Monetary Policy Statement, and what it means for the housing market.

- Image:

- Asset Name: Regional resilience but weaker main centres in May

- Overview Text:

- Image:

- Asset Name: Conflicting forces to shape New Zealand’s property market in 2025

- Overview Text:

- Image:

- Asset Name: Monthly Housing Chart Pack - May 2025

- Overview Text:

- Image:

- Asset Name: Construction conditions look set to improve in 2025

- Overview Text: The cost to build a ‘standard’ single storey three bedroom, two-bathroom standalone dwelling* in NZ increased by 0.6% in the three months to December, half the 1.1% growth seen in the third quarter of 2024 and also below the long-term average quarterly rise of 1.0%.

- Image:

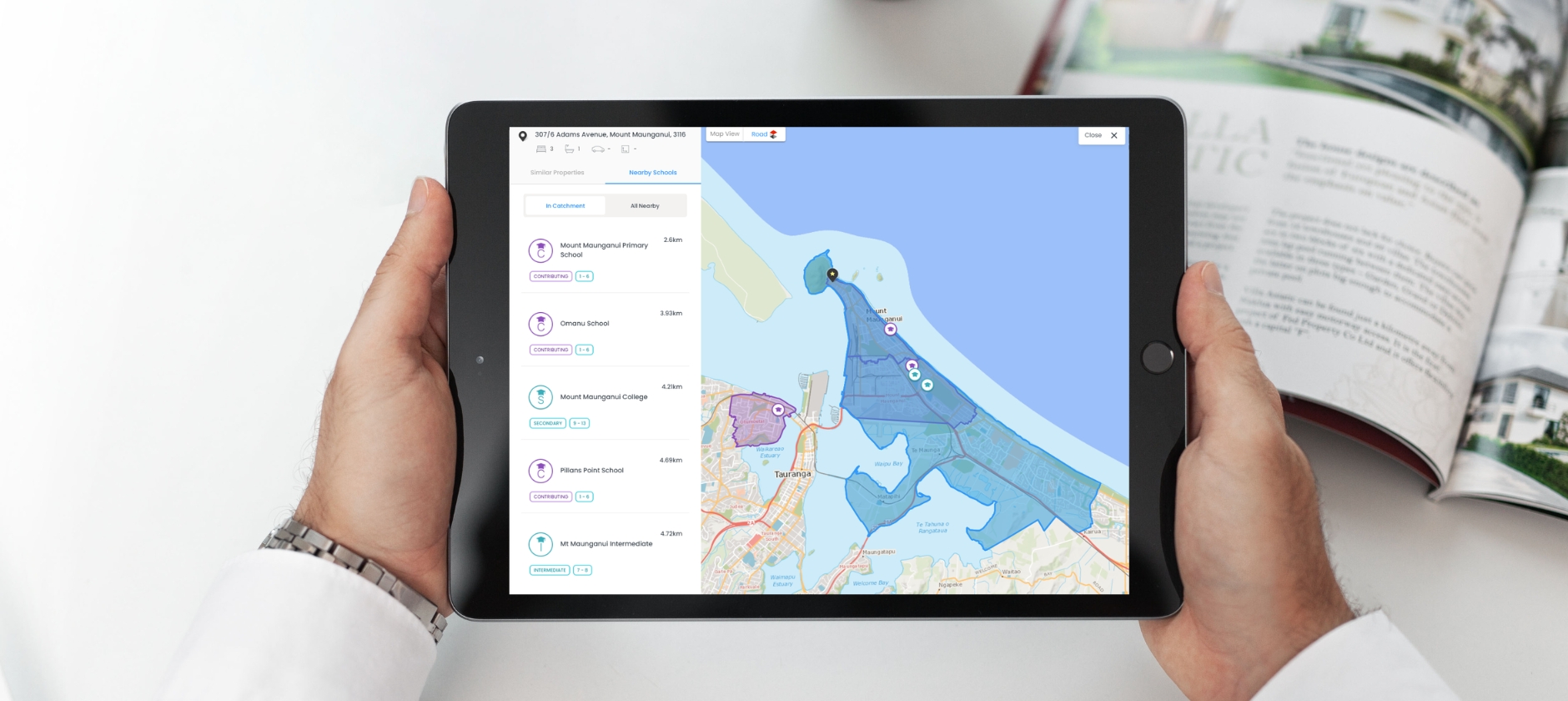

- Asset Name: Titles Transaction Report, School Catchments and Flood Zones – All Now Available in Property Guru

- Overview Text: When it comes to property decisions, having the right information at your fingertips can make all the difference. That’s why the latest updates to Property Guru are designed to help you work smarter and deliver faster, clearer insights to your clients.

- Image:

- Asset Name: Monthly Housing Chart Pack - April 2025

- Overview Text:

- Image:

- Asset Name: Momentum gradually builds in market upturn

- Overview Text: Property values in Aotearoa New Zealand rose by +0.3% in April, continuing the string of modest gains since the start of the year.

- Image:

- Asset Name: NZ’s regional property markets diverge since peak

- Overview Text:

- Image:

- Asset Name: Nine in ten NZ property resellers make a profit despite market softness

- Overview Text:

- Image:

- Asset Name: The pace of OCR cutting may slow from here

- Overview Text: Chief Property Economist Kelvin Davidson unpacks the May cash rate decision and Monetary Policy Statement, and what it means for the housing market.

- Image:

- Asset Name: Supporting Athena to reduce home lending risk

- Overview Text: As an innovative lender in a competitive market, Athena is always looking for an edge to enable it to provide customers with some of the best rates on the market. It is able to do this and help customers make informed decisions through its partnership with CoreLogic.

- Image:

- Asset Name: Buyer power dynamics are changing

- Overview Text: In this week's Pulse, Chief Property Economist Kelvin Davidson looks at CoreLogic's Buyer Classification data over the quarter, which showed a slight pullback by first home buyers (FHBs) while mortgaged investors gain ground.

- Image:

- Asset Name: First home buyer activity strong, but entering market later

- Overview Text:

- Image:

- Asset Name: How to turn website visits into real opportunities

- Overview Text: Every real estate business wants better data, but quality data starts with quality engagement. If your website isn’t working as hard as your agents, you may miss critical opportunities to generate leads and convert interest into action.

- Image:

- Asset Name: House values on the rise across growing number of suburbs

- Overview Text: Fresh insights from Cotality NZ’s Mapping the Market report reveal earlier signs of a pick-up for standalone houses than townhouses, as the national housing market shows fresh signs of stabilisation.

- Image:

- Asset Name: Monthly Housing Chart Pack - June 2025

- Overview Text: Here are the must know stats, facts and figures on New Zealand's residential property market.

- Image:

- Asset Name: A good time to get that extra bedroom?

- Overview Text: The cost to ‘trade up’ to a larger home remains significant across the country, but recent market movements suggest now may be a more favourable time for aspiring upgraders.

- Image:

- Asset Name: Powering 86 400's First Home Loan

- Overview Text: 86 400 is a mobile-first bank that uses smart technology to show their customers the most relevant information about their spending, savings and bills so they can plan forward, as well as look back at their spending history. Plus, with some help from CoreLogic, they now also offer home loans.

- Image:

- Asset Name: Addressing climate change, financial stability and property in New Zealand

- Overview Text: For many New Zealanders, their home is the biggest investment they’ll ever make. Because of this, the increasing physical impact of climate events such as storms and flooding on property has significant implications for Kiwis and communities, as well as the financial sector and broader economy.

- Image: