285 results found:

-

- Asset Name: Property Report

- Overview Text: The Property Report is designed to provide a comprehensive view of an individual residence within New Zealand. It includes key data for the property such as property sales history, listings history, recent sales information from nearby properties and market value estimates where available.

- Image:

-

- Asset Name: Cordell Construction Cost Index (CCCI)

- Overview Text: The Cordell Construction Cost Index (CCCI) is a quarterly report that measures the rate of change of construction costs within the residential market and covers a typical, ‘standard’ three-bedroom, two-bathroom brick and tile single storey dwelling.

- Image:

-

-

- Asset Name: Top Performing Lead Generation Call Scripts

- Overview Text: To help you increase the effectiveness of your call sessions, download our eBook providing valuable insights and actionable strategies to help you master your lead generation calls.By leveraging technology and human engagement, you can unlock the full potential of your data, demonstrate your value proposition and deliver an exceptional experience.

- Image:

-

-

- Asset Name: e-book: Social media advertising

- Overview Text: In the real estate market, where attention equates to success, the shift towards online advertising has become non-negotiable for high-performing agents.More agents are leveraging digital platforms as they recognise the power of connecting with the right audience at the opportune moment in their buying journey.This e-book is your essential guide to understanding the property industry’s latest digital marketing trends and tools. Consider it your blueprint for how to capitalise on the undeniable benefits of social media advertising.

- Image:

-

- Asset Name: Women and Property 2024

- Overview Text: With residential real estate valued at more than $1.3 trillion in New Zealand, CoreLogic has delved into our extensive property data universe to understand how this wealth is distributed.

- Image:

-

- Asset Name: Housing Chart Pack

- Overview Text: The Housing Affordability Report analyses the relationship between property values and household incomes, saving a deposit, mortgage serviceability and rental rates relative to household incomes.

- Image:

-

- Asset Name: Housing Affordability Report

- Overview Text: The Housing Affordability Report analyses the relationship between property values and household incomes, saving a deposit, mortgage serviceability and rental rates relative to household incomes.

- Image:

-

- Asset Name: Women and Property 2023

- Overview Text: With residential real estate valued at $7.5 trillion in Australia and more than $1.3 trillion in New Zealand, CoreLogic has delved into our extensive property data universe to understand how this wealth is distributed.

- Image:

-

- Asset Name: Mapping the Market plots a testing year for NZ property values

- Overview Text: Aotearoa’s lifestyle and more affordable housing markets are among only a handful of suburbs to have defied the national property market downturn, as prices continued to fall across most of the country’s suburbs in the past three months.

- Image:

-

-

-

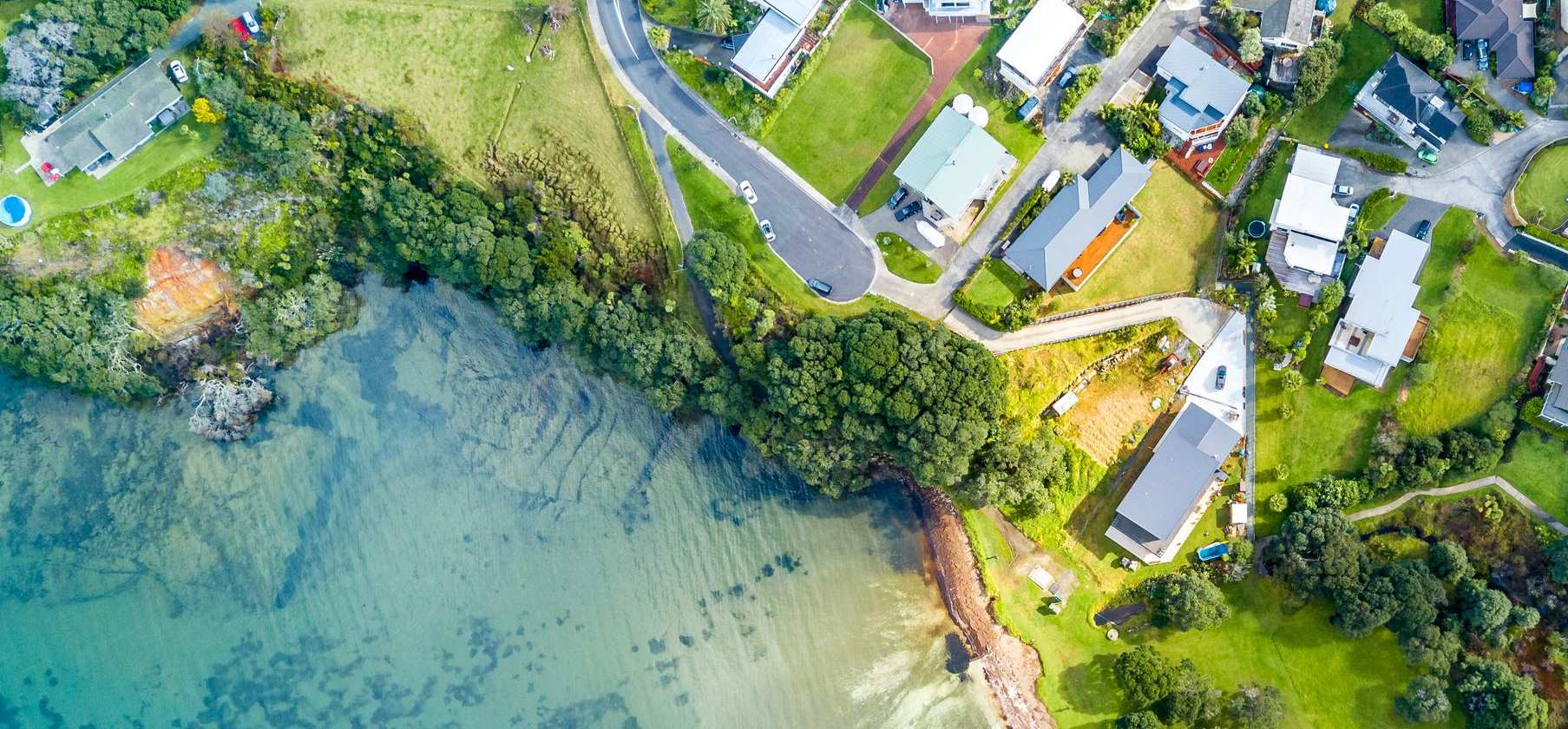

- Asset Name: Climate Risk Solutions: Measuring risks to coastal properties

- Overview Text: As a leading provider of property data and analytics, CoreLogic has been assessing the potential impact of climate-related risks on properties vulnerable to coastal erosion. Coastal Risk Scores for Financial Risk Assessment takes a closer look at the impact of climate change on specific coastal locations, and individual properties, over time.

- Image:

-

- Asset Name: Women and Property 2021

- Overview Text: With residential real estate valued at more than $1.3 trillion in New Zealand in 2021(now up to $1.7 trillion in 2022), CoreLogic has delved into our extensive property data universe to understand how this wealth is distributed.

- Image:

-

- Asset Name: Best of the Best Report

- Overview Text: CoreLogic’s annual Best of the Best report provides suburb-level insights across a variety of measures to reveal Aotearoa’s best and worst performers over the last 12 months. It features a review of the year that was as well as an exclusive outlook on what lies ahead.

- Image:

-

- Asset Name: Property insurance calculations made easy

- Overview Text: On 12 August, Richard Deakin and Gary Thornley from data and analytics provider CoreLogic hosted an ANZIIF webinar entitled Taking the guesswork out of property insurance. They explained how insurance calculators can help insurers make fast, informed property evaluations – but only if they're supported by the right data.

- Image:

-

- Asset Name: Property prices rise in more than one in 10 NZ suburbs

- Overview Text: Despite soft market conditions persisting across most of Aotearoa New Zealand, dozens of suburbs have defied the downturn, increasing in value in the past three months and providing evidence the bottom of the market is approaching.

- Image:

-

- Asset Name: House Price Index

- Overview Text: The CoreLogic House Price Index (HPI) provides a reliable indication of property value movement throughout New Zealand, offering an understanding of property values and how they are changing, and assisting with comparisons between areas.

- Image:

-

- Asset Name: Property Vulnerability Index

- Overview Text: The Property Vulnerability Index analyses how an economic downturn or change in market conditions may impact property in different parts of the country.

- Image:

-

- Asset Name: Pain & Gain Report

- Overview Text: A vital research paper into the wealth created by New Zealand’s largest asset class, the quarterly Pain and Gain Report provides a national overview on the proportion of properties resold for a nominal loss or gain.

- Image:

-

- Asset Name: First Home Buyer Report

- Overview Text: Utilising CoreLogic’s Buyer Classification data, the FHB Report delves into what they’re buying, where they’re buying, and what prices they’re paying.

- Image:

-

- Asset Name: Property Market and Economic Update

- Overview Text: The Property Market and Economic Update provides a comprehensive overview of Aotearoa’s residential market value, house price index, sales volumes, rents, listings and buyer classification data.

- Image:

-

-

- Asset Name: A Short Look Back At Past Property Cycles

- Overview Text: Some of the main centres have seen small falls in property values over the past few months, but there's no reason to think that these drops will become more significant or sustained.

- Image:

-

-

-

- Asset Name: How does the bank value your home for a mortgage?

- Overview Text: It would be an interesting analysis to do: how many current property owners are enjoying their property asset value gains through shrewd planning, and how many are enjoying it through sheer luck.

- Image:

-

- Asset Name: Mapping the market: demonstrating data, visually.

- Overview Text: As much as I love getting stuck into a data heavy spread-sheet; I do get that not everyone is with me on that. Luckily, CoreLogic NZ has a very proud heritage and ongoing drive for geospatial excellence, so we can use that technical expertise to deliver the data story in a visual way too.

- Image:

-

-

- Asset Name: How long do owners hold their properties for?

- Overview Text: The length of time that properties are being held onto before they're sold has fallen, but even at its current median of about 7.4 years (down from the peak of 8.2 in 2016) it's still quite a bit higher than in 2007 when it was a short 3.8 years.

- Image:

-

-

- Asset Name: Get the most complete view of flood risk throughout New Zealand

- Overview Text: Despite the devastation caused by earthquakes in recent years, according to the National Emergency Management Agency flooding is actually the greatest hazard in New Zealand, in terms of frequency, losses, and civil defence emergencies*.

- Image:

-

- Asset Name: Women and Property 2025

- Overview Text: As New Zealanders engage in conversations around equity in property ownership, CoreLogic has commissioned new research into property ownership among men and women across the country.

- Image:

-

- Asset Name: Patchy price falls starting to appear across New Zealand suburbs

- Overview Text: New Zealand's housing market has reached a clear turning point, as stretched affordability, higher mortgage rates and reduced credit availability cause growth rates to slow, or even turn negative, in many areas of the country.

- Image:

-

- Asset Name: It's still tough out there for a first home buyer to get a mortgage

- Overview Text: If you're looking for one part of the housing market jigsaw to really keep an eye on this year, you wouldn't go too far wrong with the mortgage sector. With interest rates higher, regulatory pressures still in force, and a large number of borrowers needing to refinance an existing fixed loan this year, it's all action.

- Image:

-

-

-

-

-

-

-

- Asset Name: Find properties faster: RPNZ boosts search capability

- Overview Text: At CoreLogic, we're always looking for ways to improve the digital experience for our customers. We value customer feedback, as it has enabled us to redesign our market-leading RPNZ platform to deliver the functionality our users want.

- Image:

-

- Asset Name: Rethinking the mortgage journey

- Overview Text: Using property data-driven digital processes to help drive better outcomes for both lenders and borrowers.

- Image:

-

-

- Asset Name: Valuations in uncertain times

- Overview Text: During periods of market instability, valuations are critical for property and the banking industry. Valuers now face the challenge of navigating uncertainty and supporting the needs of lenders now and in the future.

- Image:

-

-

-

-

-

- Asset Name: Dealing with professional indemnity challenges

- Overview Text: Insurers are placing new limitations on professional indemnity (PI) cover for property valuers. So what does this mean for the mortgage industry, and what are the options for valuation firms?

- Image:

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

- Asset Name: Recent surge in property prices may have widened gender wealth gap

- Overview Text: Surging home values caused by a global environment of low interest rates, tight supply and strong buyer demand may have widened the wealth gap between those that own housing, and those that don't, amplifying the need to understand trends around women and home ownership.

- Image:

-

-

-

- Asset Name: Women and Property 2022

- Overview Text: Don’t miss this unique report to understand where Kiwi and Australian women are forging ahead – and how their property choices could reinforce their gender wealth gap over time.

- Image:

-

- Asset Name: Current investor landscape: a focus on high yields?

- Overview Text: Over the next few years, capital gains may well be harder to come by for property investors, which means the ‘nuts and bolts’ are likely to become more important – a focus on cost control, pushing up rents if they can, and perhaps most importantly for new buyers, getting the properties with the highest yields (for acceptable risk). But where are those yields and which property types might look the most appealing?

- Image:

-

-

- Asset Name: Market Pulse: Debt-backed buyers are really starting to struggle

- Overview Text: Our latest Buyer Classification figures highlight what you might call a ‘debt vs equity' split in the market, with mortgaged investors and first home buyers seeing low/falling shares of property purchases, but cash investors and movers having a rising presence. To be fair, these changes in market share need to be viewed in the context of lower overall numbers of transactions. But with loan to value ratio rules still pretty tight and mortgage rates rising, buyers with a higher equity base may continue to be key players in a debt-constrained housing market this year.

- Image:

-

- Asset Name: Reserve Bank goes big and mortgage rates have further to rise

- Overview Text: There was never any doubt that the official cash rate (OCR) would be increased today. The only uncertainty was how big the rise would be, and in the end the Reserve Bank opted for the ‘shock factor' of a 0.5% increase, taking the OCR to 1.5% – its highest level since August 2019 (when it was dropped from 1.5% to 1% on the 7th).

- Image:

-

-

-

- Asset Name: Long-awaited property market slowdown finally arrives

- Overview Text: Higher interest rates, lower sales volumes, and flatter house prices are forecast for the rest of the year after a weak start to 2022 for New Zealand's previously overheated property market.

- Image:

-

-

- Asset Name: Equity is a rising factor for property buyers

- Overview Text: CoreLogic's Buyer Classification data for May shows some fairly stable patterns for first home buyers (FHBs) and mortgaged multiple property owners (MPOs), a slight dip for movers, but an increased market share for cash MPOs. In the current environment of tougher credit conditions and higher mortgage rates, it’s logical that buyers with a greater equity base would be seeing a higher market presence (albeit amidst the fall in the number of sales).

- Image:

-

-

- Asset Name: Residential property resales show first sign of slowdown

- Overview Text: The resale performance of residential real estate has started to weaken, CoreLogic NZ’s latest Pain & Gain report found. In Q1 2022, 99.1% of properties resold made a gross profit, or gain, on the previous purchase price, down marginally from 99.3% in Q4 2021.

- Image:

-

- Asset Name: Did you know? Five market trends to keep in mind

- Overview Text: In this Market Pulse, Chief Property Economist Kelvin Davidson explores five things to know about the NZ property market that are lesser-known, but important when gauging market conditions today.

- Image:

-

- Asset Name: Higher OCR will keep the pressure on the housing market

- Overview Text: After the knife-edge decision in April about whether to raise the official cash rate (OCR) by 0.25% or 0.5%, today’s decision was clearer cut. The 0.5% increase that was duly delivered took the OCR back to 2%, a level not seen since November 2016, prior to the decision on the 10th of that month to lower it to 1.75%.

- Image:

-

-

- Asset Name: CoreLogic HPI: Widespread fall in NZ house prices continues

- Overview Text: CoreLogic’s House Price Index (HPI) shows that the downwards momentum in NZ residential real estate values continued throughout May 2022. With housing credit tight and getting more expensive by the week, this trend towards weaker housing market conditions is likely to continue.

- Image:

-

-

-

- Asset Name: Equity could be king this year

- Overview Text: Most observers of NZ's housing market will be fully aware that an abrupt change is underway, with poor affordability, higher mortgage rates, and tighter credit availability all weighing on property sales volumes (giving total listings a chance to replenish) and prices.

- Image:

-

-

-

- Asset Name: A temporary respite for low deposit borrowers?

- Overview Text: The latest Reserve Bank mortgage lending data shows that overall activity remains subdued, with interest-only lending drifting lower, albeit there has been a bit of a respite for new low-deposit borrowers in the past few months.

- Image:

-

-

-

- Asset Name: Construction costs rising at the fastest pace on record

- Overview Text: CoreLogic NZ’s Cordell Construction Cost Index (CCCI) for Q2 2022 showed national residential construction cost pressures have continued to escalate, with both quarterly and annual rates of indexed growth reaching new record highs.

- Image:

-

-

- Asset Name: House Price Index shows property values falling at fastest pace since the GFC

- Overview Text: CoreLogic’s House Price Index (HPI) shows that the current market downturn became further entrenched in July. The national measure of property values fell a further -0.9% in July, taking the three month drop in values to -2.5%, the largest quarterly fall since October 2008 (-3.4%), when the market was in retreat from the Global Financial Crisis (GFC).

- Image:

-

-

- Asset Name: First home buyers: get in now or wait?

- Overview Text: A question we’ve been asked many times recently is: as a first home buyer (FHB), should I purchase now, or wait and see if I can get a ‘bargain’ later?

- Image:

1 2 3